Schedule Eic Worksheet

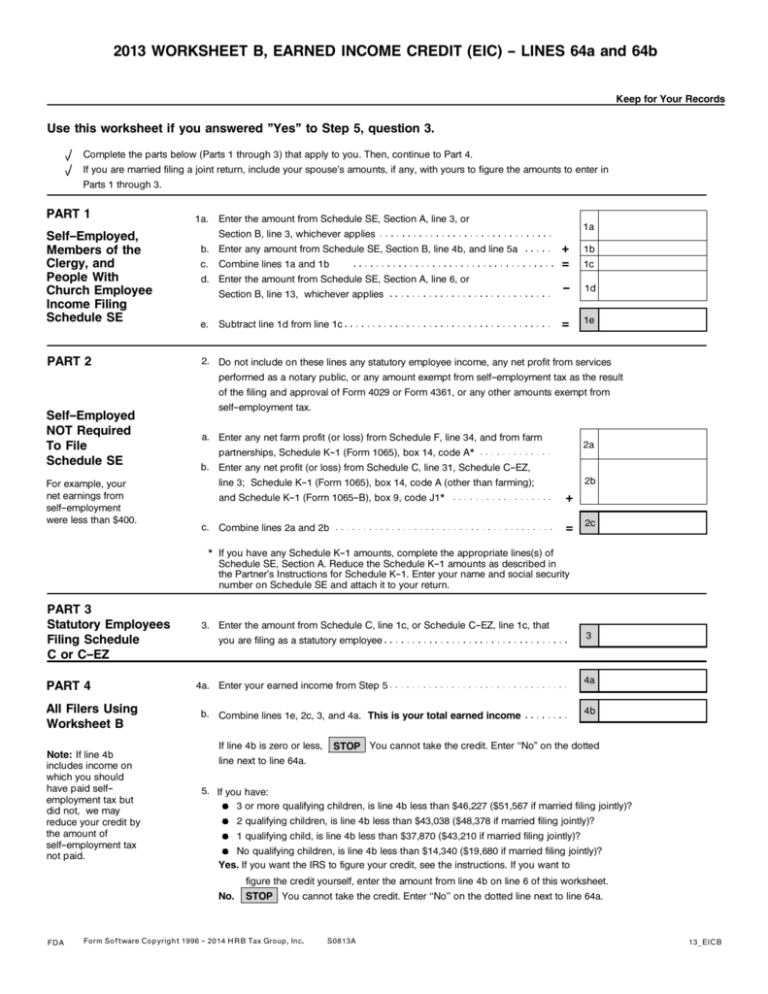

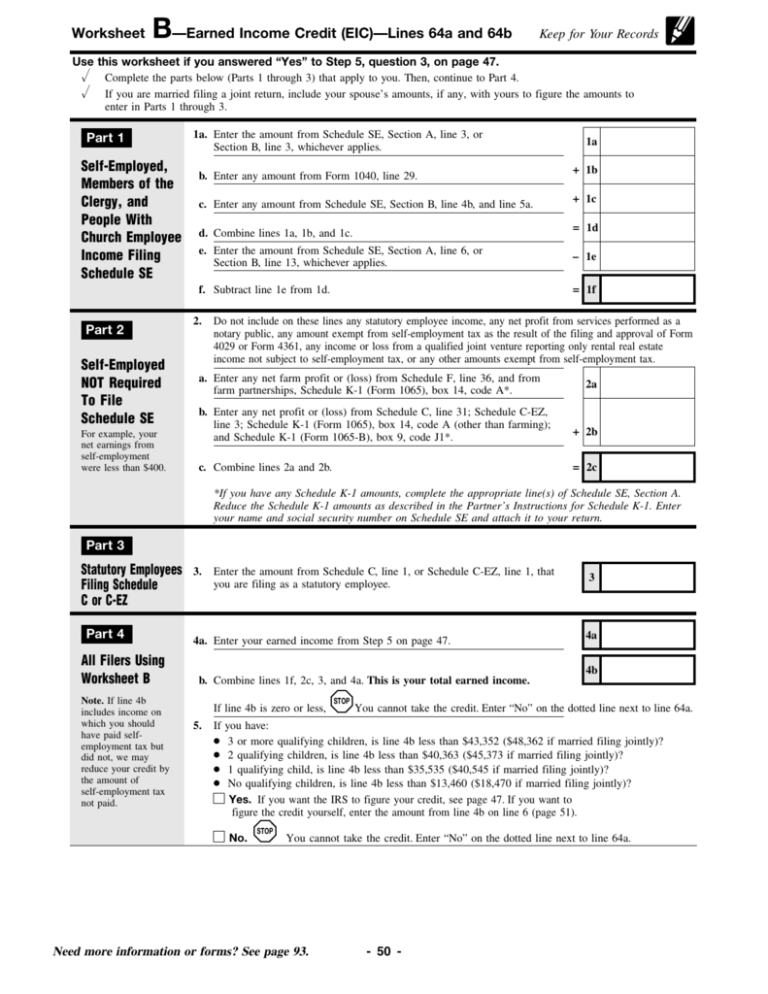

Use EIC Worksheet B if you were self-employed at any time in 2020 or are a member of the clergy a church employee who files Schedule SE or a statutory employee filing Schedule C. Fill Online Printable Fillable Blank Earned Income Credit EIC Worksheet TheTaxBook Form.

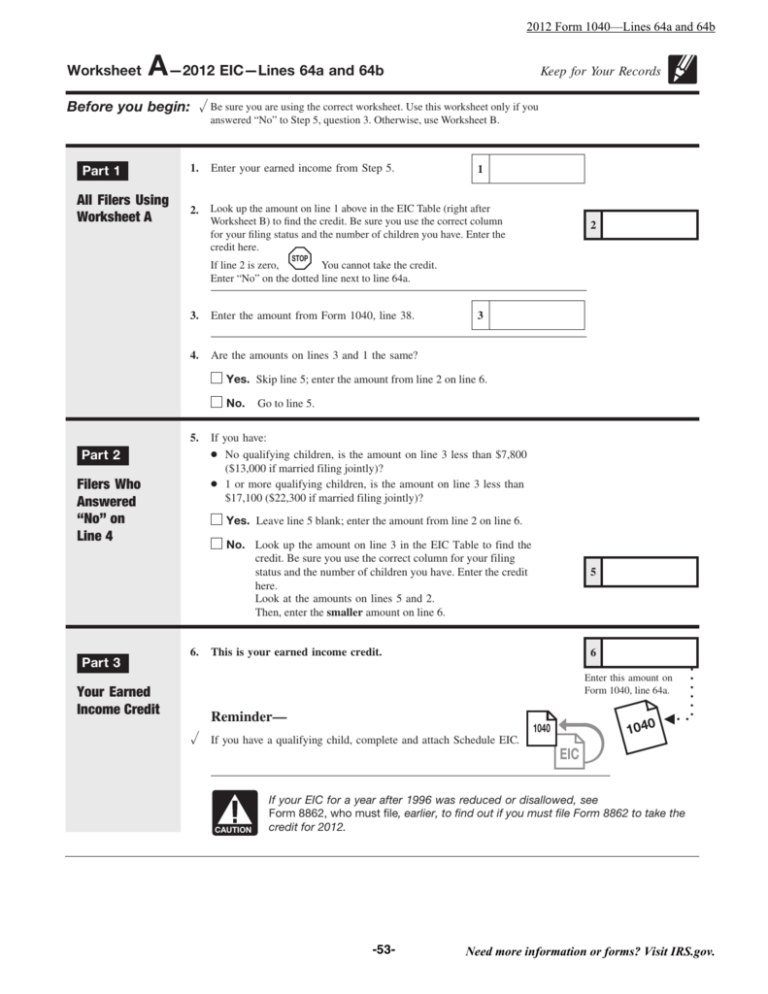

Worksheet 2012 Eic Lines 64a And 64b Before You Begin All

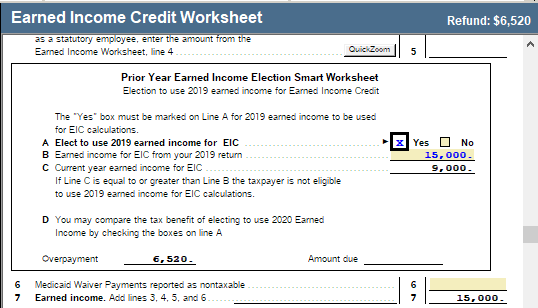

The easiest way to suspend the calculation of EIC.

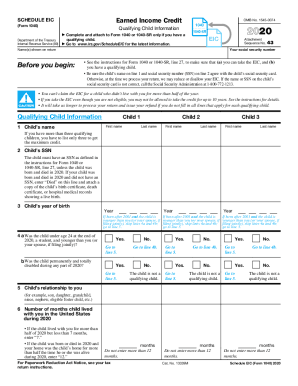

Schedule Eic Worksheet. Completed worksheet b relating to the eic in your instructions for forms 1040 and 1040 sr your earned income from worksheet b line 4b plus 1 all of your nontaxable combat pay if you did not elect to include it in earned income for the eic and 2 the medicaid waiver payments you subtracted in line 5 of step 5 of the eic instructions if any. When filing Schedule EIC and claiming the credit with a qualifying child or children it is very important that you find your credit amount in the appropriate column for your filing status and number of qualifying children on the earned. As mentioned earlier even if you dont earn enough money to borrow federal income tax you still need to.

X Your income on Form IT-40 line 1 or Indianas Schedule A line 36A must be less than 47400. Start a free trial now to save yourself time and money. First you can calculate the credit yourself using the earned income credit worksheet and earned income credit table found in the 1040 Instruction Booklet.

Therefore the signNow web application is a must-have for completing and signing 2017 eic worksheet on the go. Question 1 of 1. To figure the amount of your credit or to have the IRS figure it.

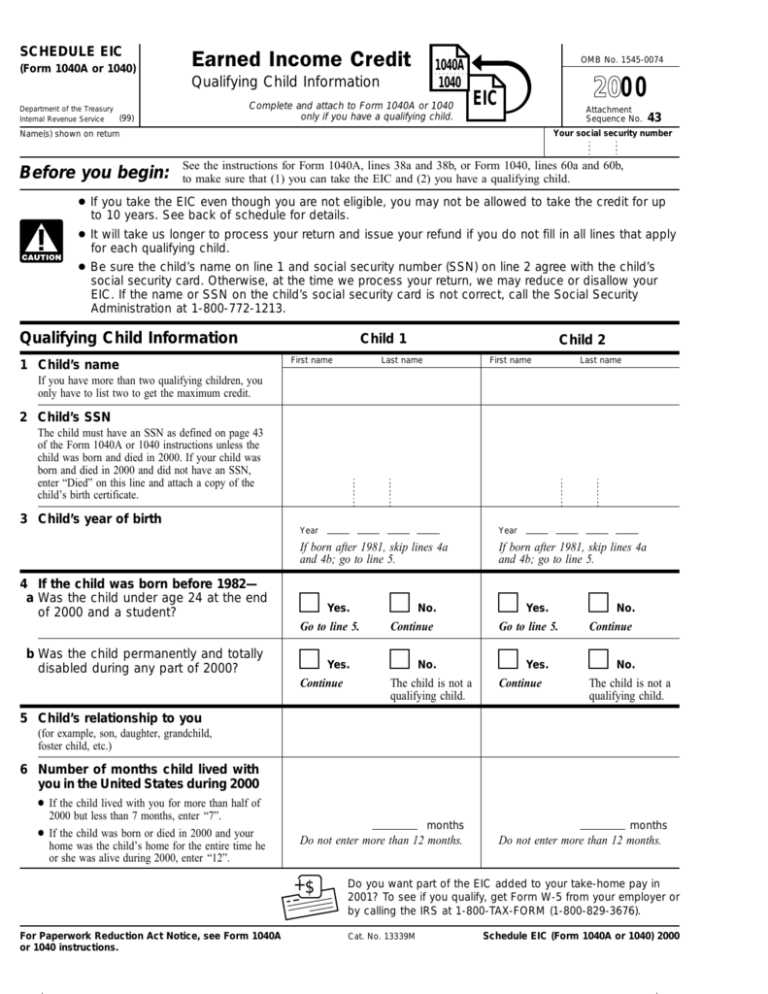

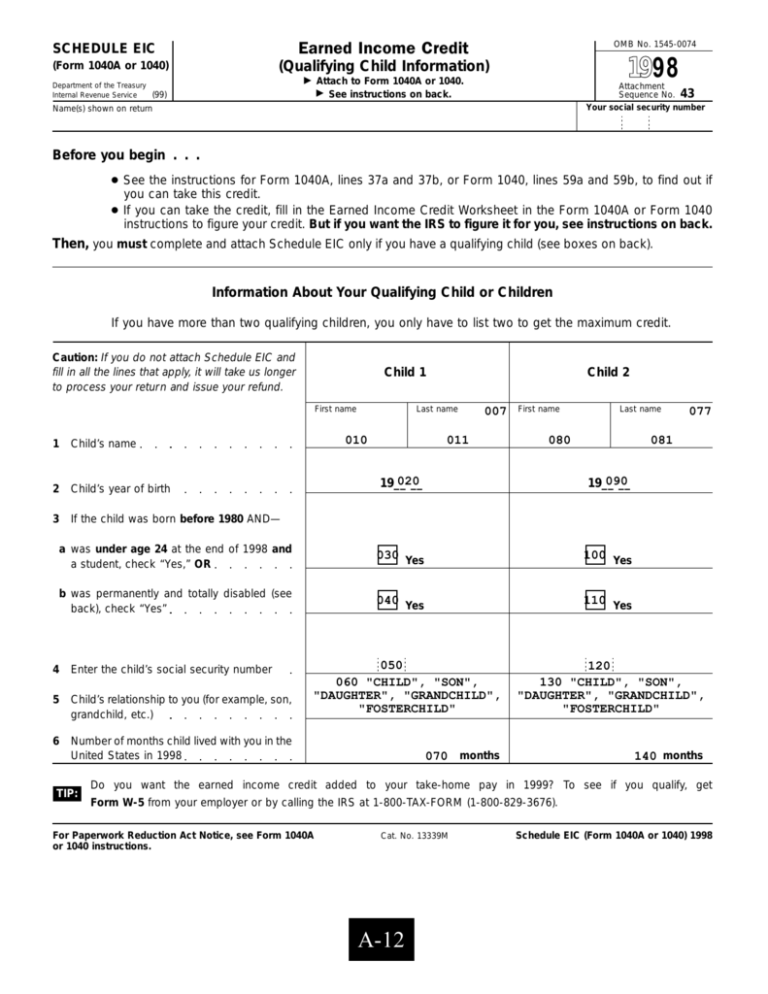

To figure the amount of your credit or to have the IRS figure it for you see the instructions for Form 1040A lines 42a and 42b or Form 1040 lines 66a and 66b. Earned Income Credit EIC is calculated based on the entries made throughout the program. Enter the credit here.

Taxpayers who claim the EIC based on one or more qualifying children are required to attach the _____ to their return. They use EIC Worksheet B shown on pages 37 and 38 to figure their EIC of 4716. Schedule eic 2017ablets are in fact a ready business alternative to desktop and laptop computers.

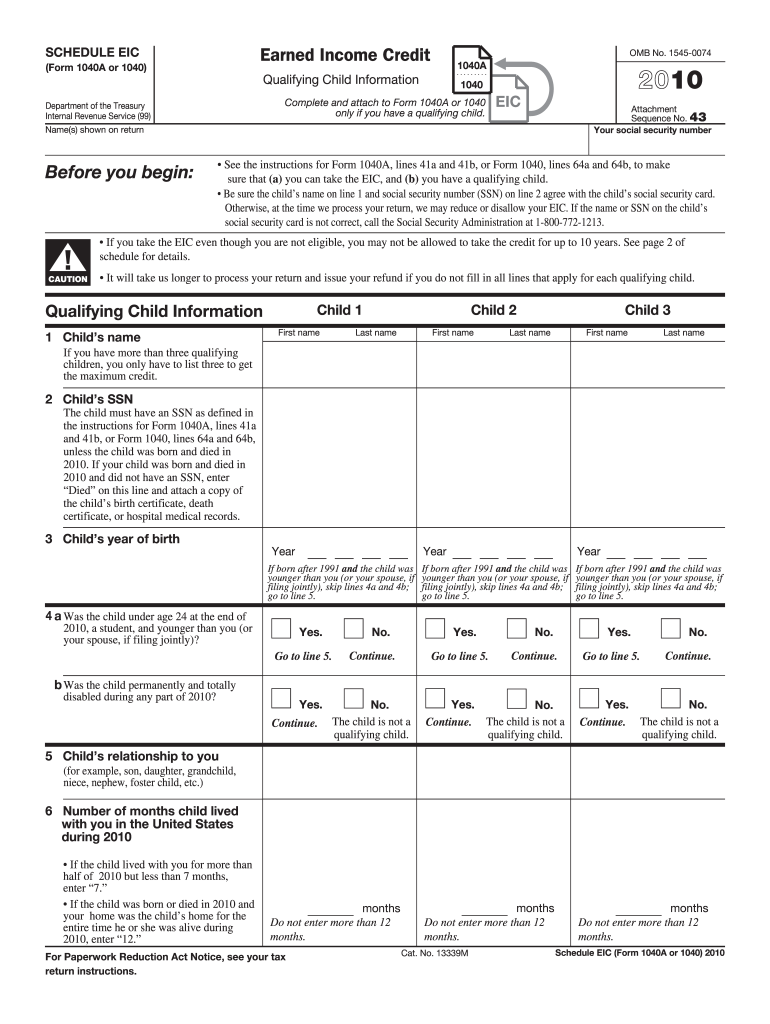

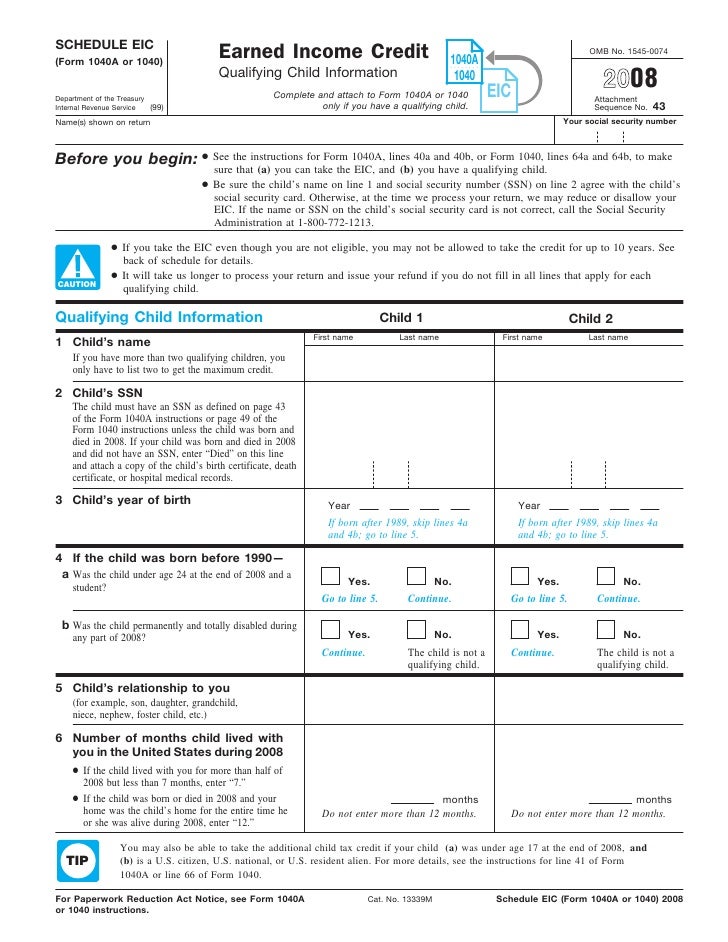

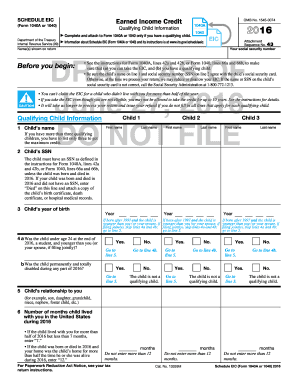

After you have figured your earned income credit EIC use Schedule EIC to give the IRS information about your qualifying children. Use Fill to complete blank online THETAXBOOK pdf forms for free. If any of the following situations apply to you read the paragraph and then complete EIC Worksheet B.

1a enter the amount from schedule se section a line 3. Download documents on your laptop or mobile device. If the return does not qualify for EIC page 2 of the EIC Worksheet will list what disqualified the credit.

Make them reusable by creating templates include and fill out fillable fields. You will need to attach a Schedule EIC to the Federal Income Tax Return to claim the credit. But before you despair lets get rid of the confusion when claiming income tax deductions on income tax returns.

Worksheet B Indianas Earned Income Credit EIC Keep for your records Use this worksheet if you answered Yes to Step 6 question 3. 1 2 Complete the Worksheet for Line 2 in the instructions if you filed Schedule M1NC. Available for PC iOS and Android.

Fill out forms electronically working with PDF or Word format. Then continue to Part 4. To figure the amount of your credit or to have the IRS figure it for you see the instructions for Form 1040 or 1040-SR line 18a.

Schedule IN-EIC must be filed with your tax return in order for you to be eligible to claim Indianas EIC. If updated the 2020 tax year PDF file will display the prior tax year 2019 if not. After you have figured your earned income credit EIC use Schedule EIC to give the IRS information about your qualifying children.

Complete either Worksheet A or Worksheet B to figure your Indi-ana EIC. There is also an Earned Income Credit Calculator to help you figure out your Earned Income Credit amount. If you were self-employed or used Schedule C or C-EZ as a statutory employee enter the amount from the worksheet for self employed taxpayers Add lines 3 and 4 Look up the amount on line 5 above in the EIC Table on pages 62-70 to find your credit.

X Complete the parts below Parts 1 through 3 that apply to you. Approve documents by using a lawful electronic signature and share them via email fax or print them out. Enter the result here.

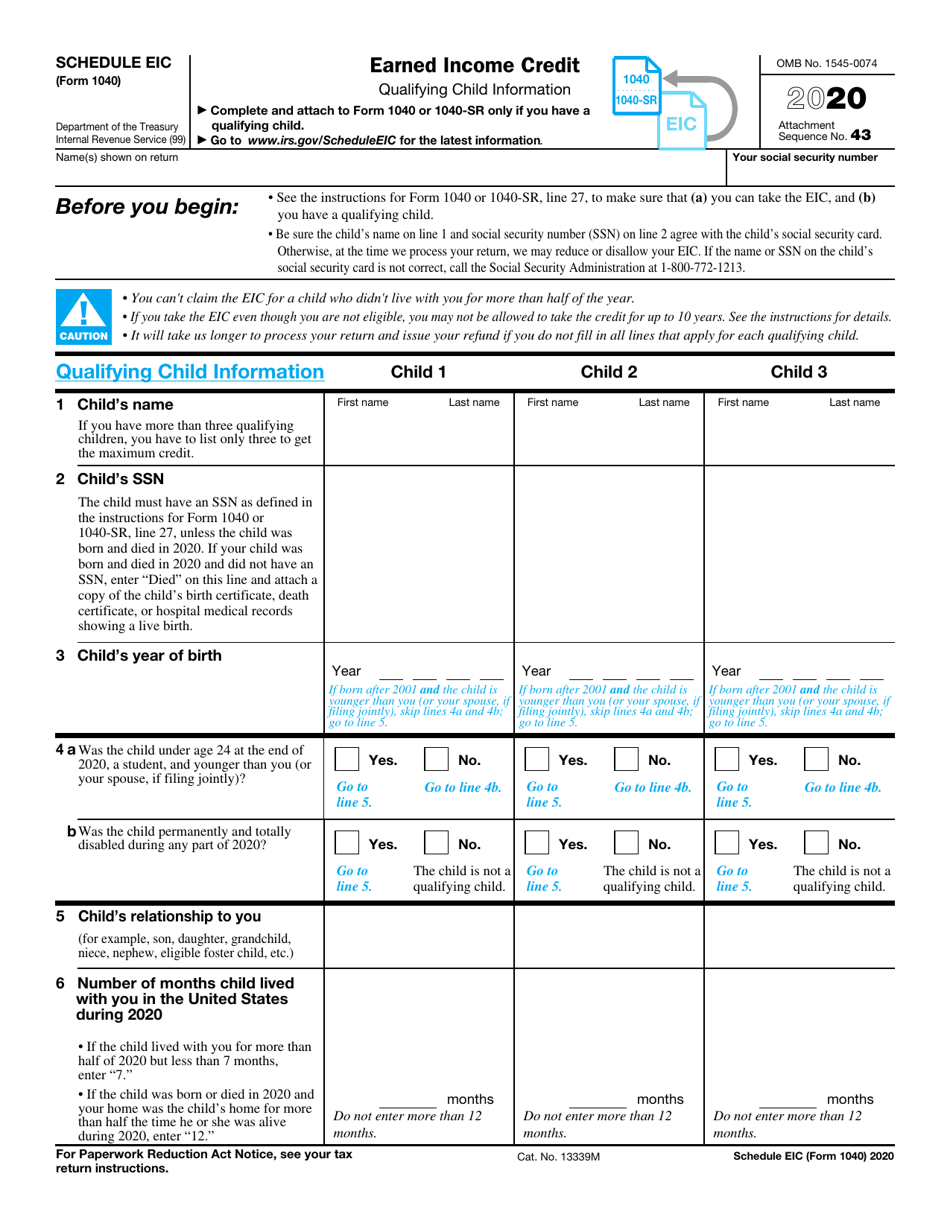

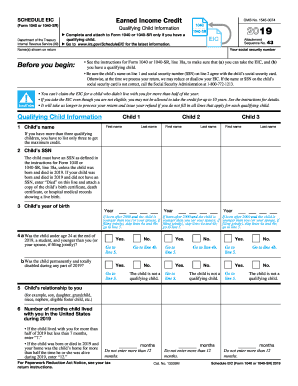

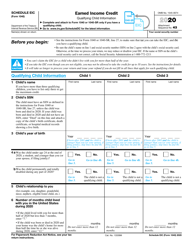

Approve documents with a lawful digital signature and share them via email fax or print them out. Schedule EIC Form 1040 or 1040-SR 2019. Schedule EIC Form 1040 2020.

2 3 Add lines 1 and line 2. Schedule eic worksheet b Reading the instructions attached to IRS Form 1040 is a heart-numbing experience. Increase your efficiency with effective service.

Increase your productivity with effective solution. Open the Federal Information Worksheet. Section A Figure Your Indiana Earned Income Credit Line.

Schedule EIC Form 1040 or 1040-SR is used by filers who claim the earned income credit to give the IRS information about the qualifying child. They also complete Schedule EIC not shown and attach it to their Form 1040. The form analyzes the earnings of the tax filer and calculates just how much to be paid out as tax or refund.

EIC use Schedule EIC to give the IRS information about your qualifying children. Information about Schedule EIC Form 1040 or 1040-SR Earned Income Credit including recent updates related forms and instructions on how to file. Make them reusable by creating templates include and fill out fillable fields.

2018 Schedule EIC Form. All forms are printable and downloadable. X You must complete Worksheet A or Worksheet B which can be found in the IT-40 or IT-40PNR instruction booklets.

1 Enter your total earned income from line 1 of EIC Worksheet A or line 6 of EIC Worksheet B see instructions. After you have completed the worksheet return to these instructions and finish Schedule IN-EIC. 2021 eic worksheet b line 4a.

The worksheet can be found in the instruction booklet for IRS Form 1040. Filled in Worksheet 1 for Steve and Linda Green Worksheet 1. Once completed you can sign your fillable form or send for signing.

The most secure digital platform to get legally binding electronically signed documents in just a few seconds. If it is the same amount or more STOP. You are not eligible to claim Indianas EIC.

Download blanks on your laptop or mobile device. Investment Income If You Are Filing Form 1040. EIC line item instructions follow later as part of the Form 1040 general instructions booklet.

Form 1040 Schedule Eic Worksheet Form 1040 form is an IRS tax form utilized for person federal earnings tax filings by US residents. You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. Eic worksheet b 2021.

2018 1040 Instructions see EIC line instructions The Schedule EIC form is generally updated in December of each year by the IRS. Complete forms electronically using PDF or Word format. How can I suspend the EIC calculation.

Fill out securely sign print or email your eic worksheet form instantly with SignNow.

2013 Worksheet B Earned Income Credit Eic

Irs Form 1040 Schedule Eic Download Fillable Pdf Or Fill Online Earned Income Credit 2020 Templateroller

In Eic Worksheets 2020 2021 Fill Out Tax Template Online Us Legal Forms

Irs Schedule Eic 1040 Form Pdffiller

Irs 1040 Schedule Eic 2010 Fill Out Tax Template Online Us Legal Forms

Form 1040 Schedule Eic Earned Income Credit

2021 Schedule Eic Form And Instructions Form 1040

Form 1040 1040a Schedule Eic Earned Income Credit

Form 1040 Schedule Eic Fillable Earned Income Credit

Common Questions About Schedule Eic In Proseries Intuit Accountants Community

Irs Form 1040 Schedule Eic Download Fillable Pdf Or Fill Online Earned Income Credit 2020 Templateroller

Schedule Eic Fill Online Printable Fillable Blank Pdffiller

Irs Form 1040 Schedule Eic Download Fillable Pdf Or Fill Online Earned Income Credit 2020 Templateroller

Irs Schedule Eic 1040 Form Pdffiller

Posting Komentar untuk "Schedule Eic Worksheet"